Recent posts

October 27, 2021

Types of distracted driving

Learn about the dangers of distracted driving and how much money you could save by staying focused on the road. Read more

August 25, 2021

Car insurance to get you back to work

Return to the office with confidence knowing Root’s got you covered. Read more

March 17, 2021

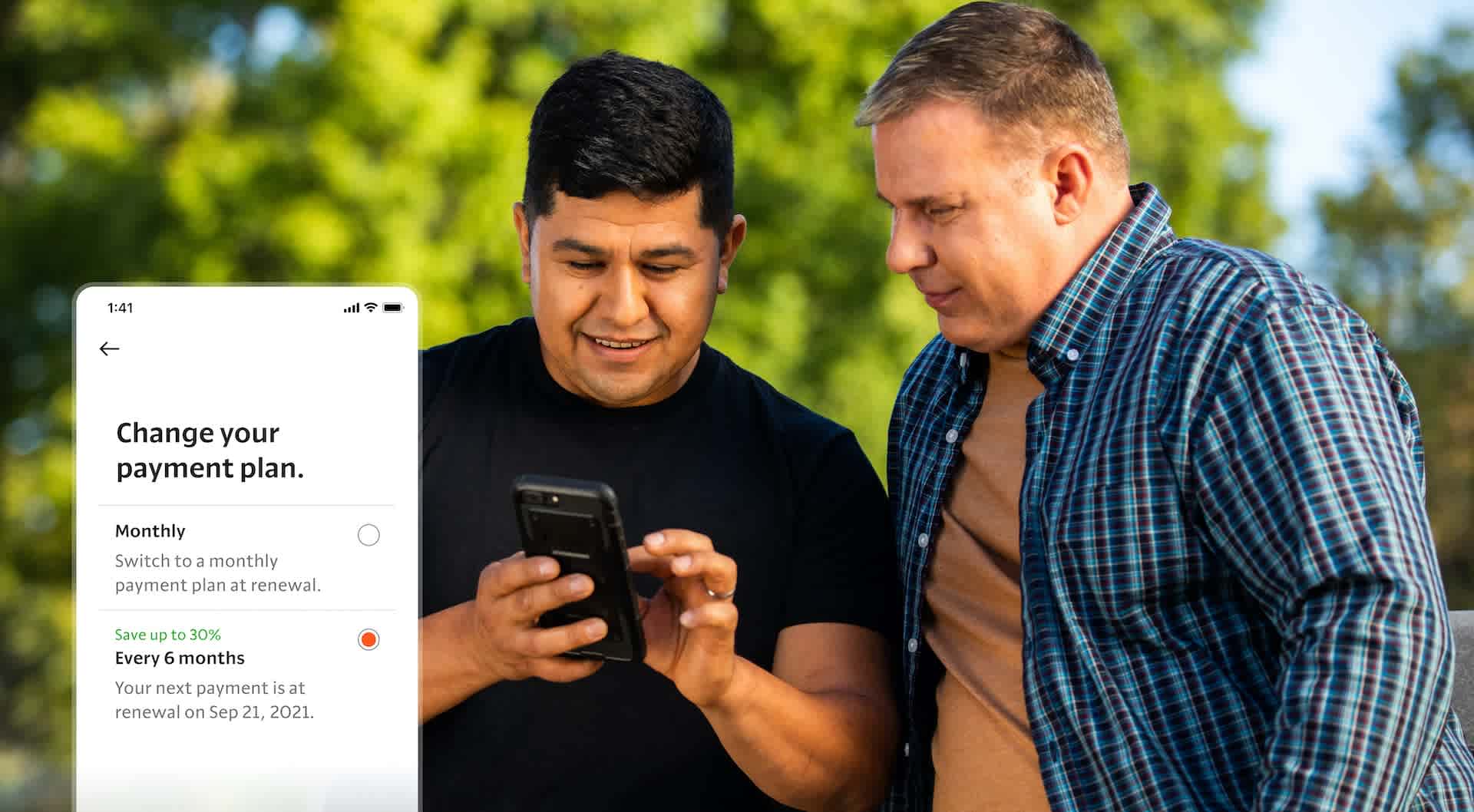

Payment options at Root

Want to change how or when you pay for your policy? We make it easy. Read more

December 01, 2020

The fair way to price auto insurance

Car insurance isn’t fair. Root is committed to unbreaking it—by basing your rate primarily on how you drive and dropping credit score by 2025. Read more

Car insurance basics

May 18, 2018

Why does my car insurance fluctuate?

Knowing the most common reasons why your car insurance rate fluctuates can help you prepare. Read more

November 07, 2018

How much coverage do you really need?

The Root insurance app can help you figure out your needs and understand coverage types, so you can decide which ones are right for you. Read more

December 31, 2019

How to choose a car insurance deductible

Your car insurance deductible is one factor that puts you in control of how much you pay for car insurance. Here are some tips for choosing a deductible that’s right for you. Read more

February 18, 2019

5 tips for switching car insurance companies

Changing your car insurance company is not as complicated as you might think, and switching could amount to big savings that are worth a small hassle. Read more

Safe driving

April 25, 2019

How to stay focused while driving

People admit to spending 13 minutes a day on their phones while driving. Here are 13 tips to help you give your full attention to focused driving. Read more

November 26, 2019

Giving up distracted driving: expert tips for ignoring your phone

We’ve all heard stories and seen the sobering statistics. Distracted driving is dangerous, and not doing it can save lives. Read more

October 24, 2018

What’s the Root test drive—and how can it help good drivers save more?

It’s easy. You drive your car like you always do. While you’re driving, our app measures things like braking, turning, and the time of day you’re behind the wheel. The better you drive, the more you could save. Read more

Root 101

February 28, 2019

Top 3 questions about Root’s test drive

At Root Insurance, your car insurance rate is based primarily on how well you drive. Really. The better you drive, the more you could save. Read more

January 29, 2018

Driver or passenger? It’s all in your test drive data.

One of the most common questions we get asked is “How does Root Insurance know whether I’m the driver or passenger during the test drive?” Read more

December 04, 2018

Navigating your Root insurance quote

Now that you’ve received a Root car insurance quote, how do you know the coverage options that best fit your needs? Our app makes choosing easy. Read more

October 30, 2018

Roadside Assistance included in every Root policy

Root includes Roadside Assistance with every policy at no extra charge—not as an add-on expense. Any service under $100 is covered for vehicles on your policy. Read more